Overtime tax calculator

Taxable income Annual gross salary - Pension Provident RAF limited to 275 of salary limited to R350k. Missouri Overtime Wage Calculator.

Overtime Calculator With Taxes Online 56 Off Myelectricalceu Com

The simplest way to work out how.

. This is your take home pay. Monthly Overtime If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10. You can enter regular overtime and one additional hourly.

A RHPR OVTM. Overtime tax calculator Using an internet overtime tax calculator can make calculating tax easy but you can also work out the number for yourself. From your payslip enter the total tax deducted to date in this tax year.

First enter your current payroll information and deductions. This is how you work it out. Monthly Overtime If you do any overtime enter the number of hours you do each month and the rate you get paid at - for.

The legal remuneration rate for overtime must is 15 times the normal wage rate so take the standard hourly wage and time it by 150 this will give you the hourly overtime wage. Federal labor law requires overtime hours be paid at 15 times the normal. Then enter the hours you expect to work and how much you are paid.

Overtime can be entered separately. Overtime Pay Rate OTR Regular Hourly Pay. Setting Up the Overtime Calculator.

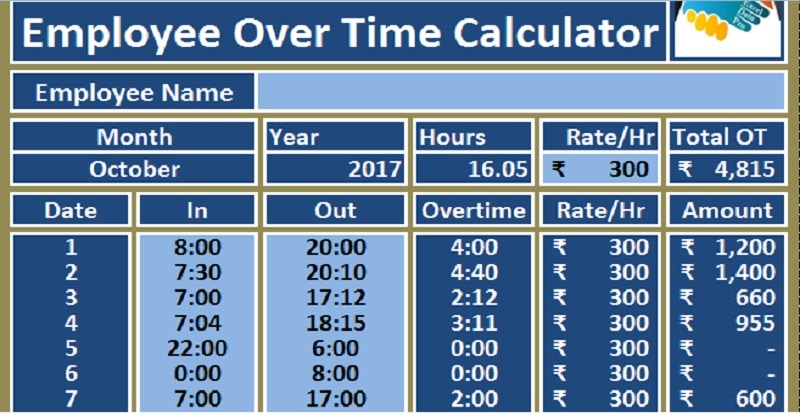

Enter your tax code. Enter your employee names or aliases in the leftmost column titled Name Under Month 1 enter your. The overtime calculator uses the following formulae.

The algorithm behind this overtime calculator is based on these formulas. Enter Hours Worked hint - enter decimal85 or. Open the overtime calculator Excel.

These calculators should not be relied upon for accuracy. Every pay period your employer withholds 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Tax codes accepted at the. In Missouri overtime hours are any hours over 40 worked in a single week. Overtime hours worked and pay period both optional.

If you dont know your tax code simply leave this blank. This easy and convenient tool will help employers and employees within the state of California to accurately calculate overtime hours worked. Regular Pay per Period RP Regular Hourly Pay Rate Standard Work Week.

Your employer then matches that contribution. The calculators on this website are provided by Symmetry Software and are designed to provide general guidance and estimates. From your payslip enter the total gross income to date in this tax year.

Overtime Calculator With Taxes Online 56 Off Myelectricalceu Com

Indiana Sales Tax Calculator Reverse Sales Dremployee

Overtime Calculator Clicktime

Creating An Employee Payslip Free Payslip Template Excel Factorial

Overtime Calculator With Taxes Online 56 Off Myelectricalceu Com

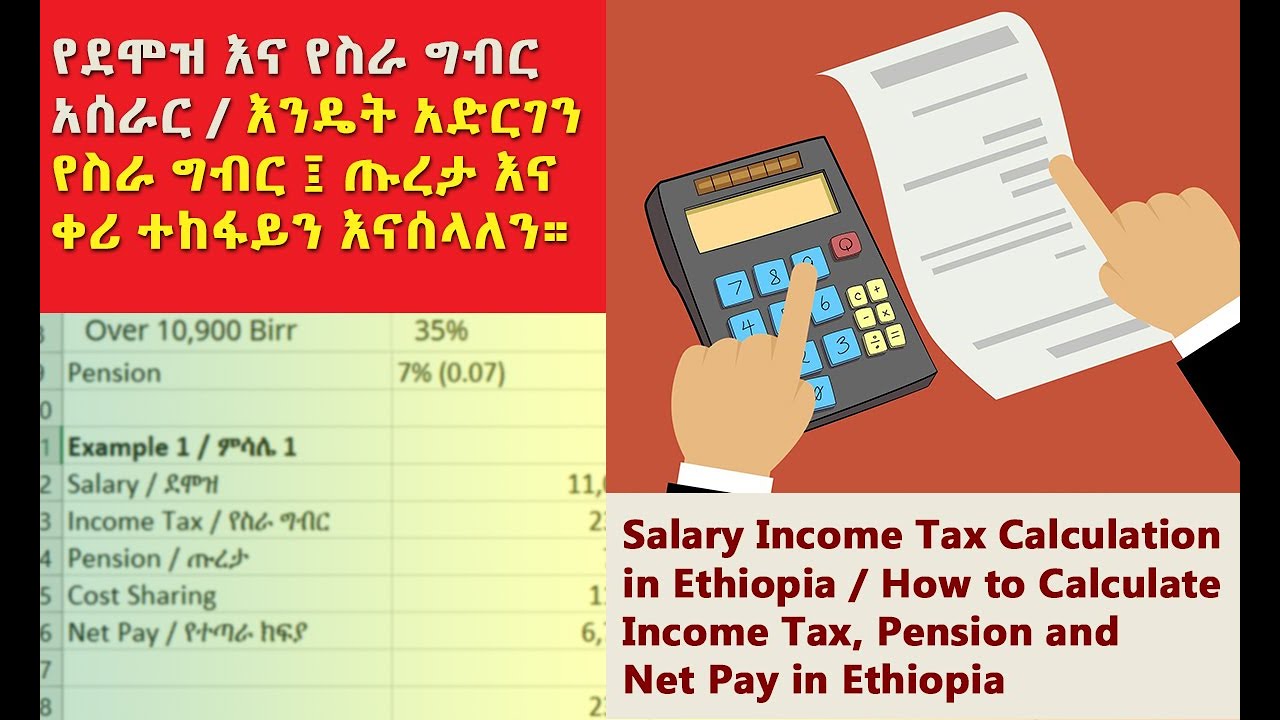

How To Calculate Employee Salary Income Tax In Ethiopia Payroll Formula Tax Rate Calculator 2021 Youtube

Solved W2 Box 1 Not Calculating Correctly

Payroll Calculator With Pay Stubs For Excel

Overtime Calculator How To Calculate Time And A Half

Download Employee Overtime Calculator Excel Template Exceldatapro

Paycheck Calculator Take Home Pay Calculator

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

How To Calculate Payroll Taxes Methods Examples More

Overtime Calculator With Taxes Online 56 Off Myelectricalceu Com

The Certified Payroll Professional Corner Regular Rate Calculation For Overtime Purposes

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Overtime Calculator